Original paper

What Goes Up May Not Come Down: Asymmetric Incidence of Value-Added Taxes

Abstract

This paper provides evidence that prices respond significantly more strongly to increases than to decreases in value-added taxes (VATs). First, using two plausibly exogenous VAT changes, we show that prices respond twice as much to VAT increases as to VAT decreases. Second, we show that this asymmetry results in higher equilibrium profits and markups. Third, we find that firms operating with low profit margins are particularly likely to respond...

Figures & Tables

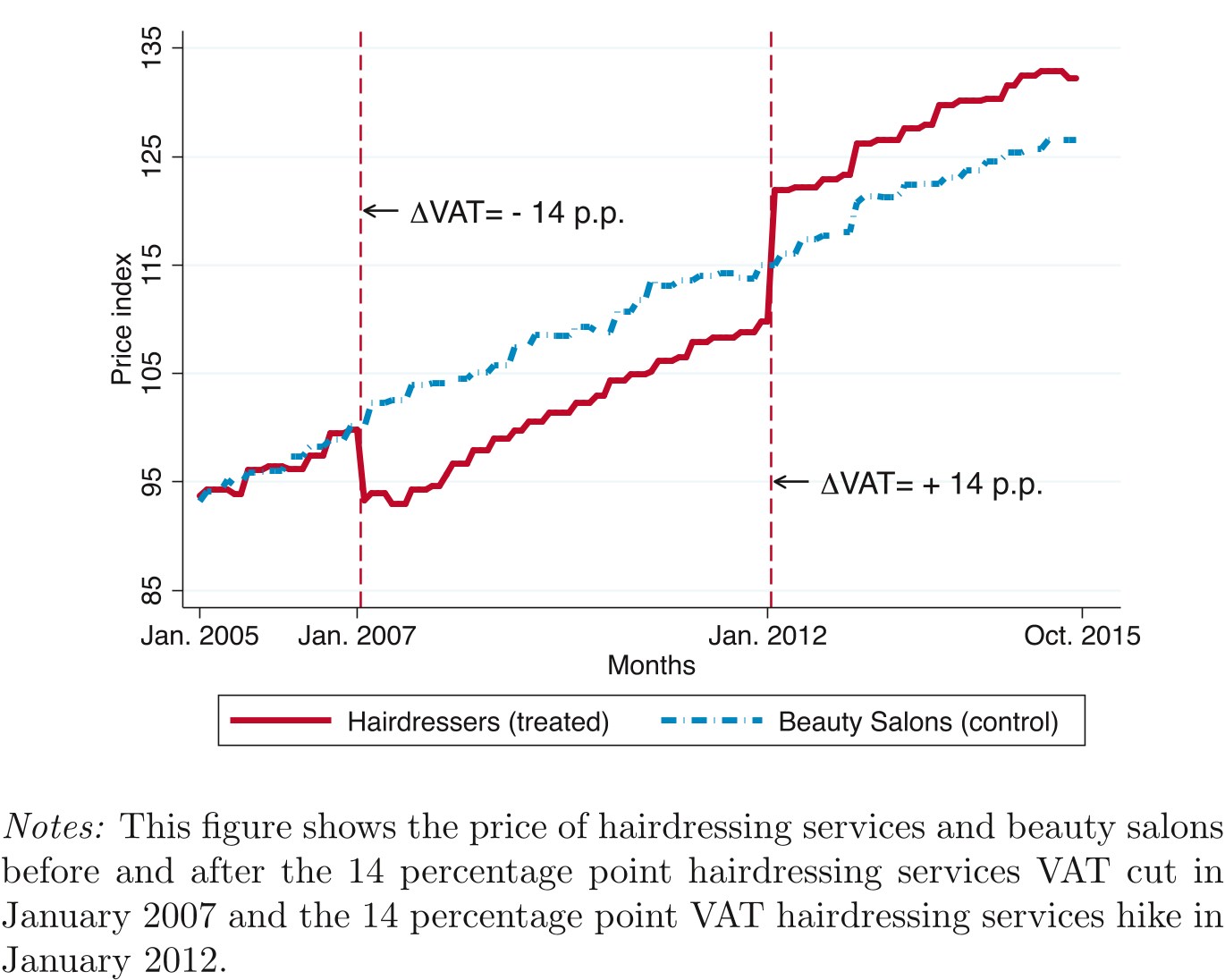

Figure 1: Finnish Hairdressing Sector VAT Reforms

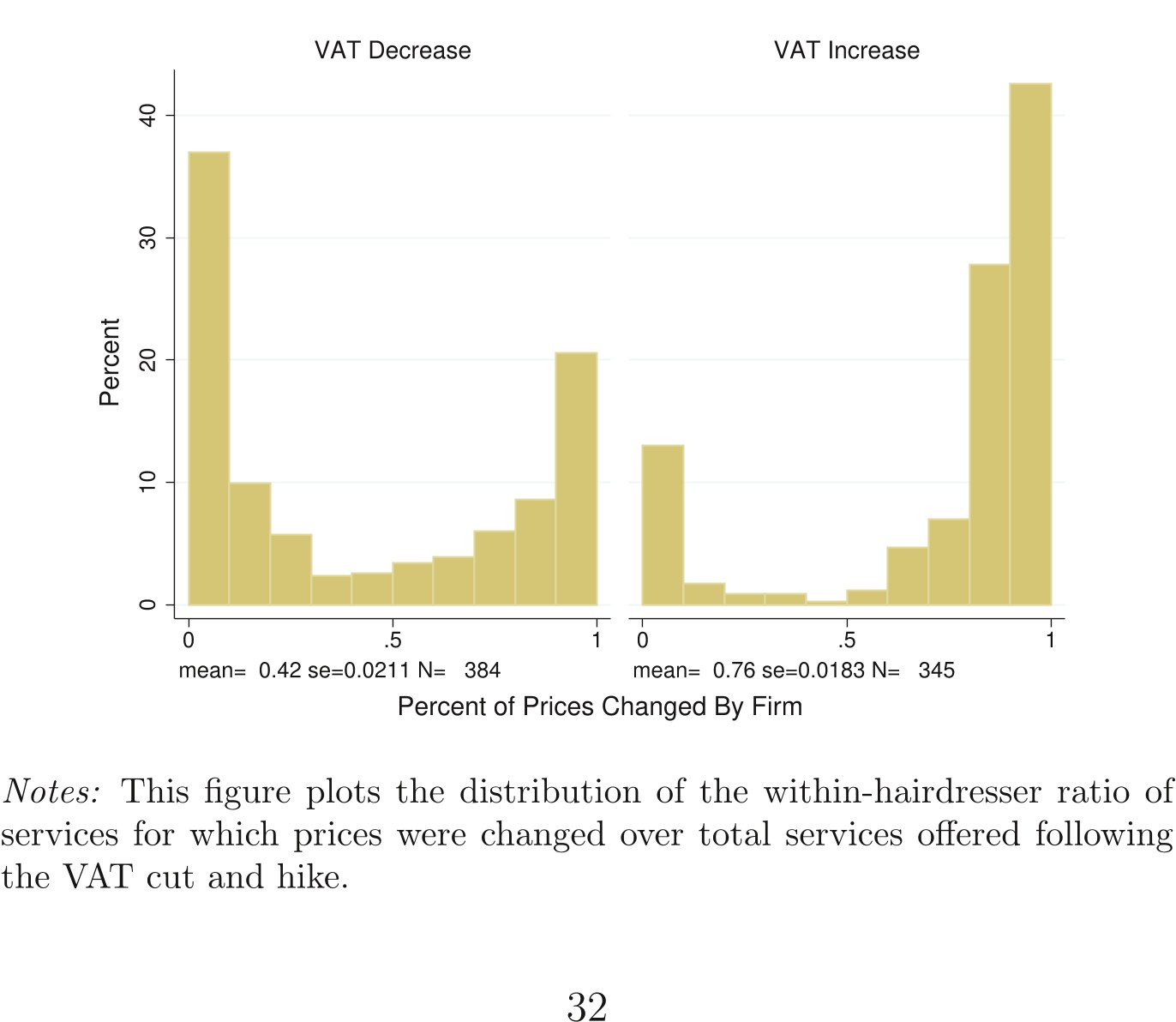

Figure 2: Proportion of Prices Changed by Hairdresser

Figure 5a plots the coefficients from a regression of log profits on year dummie...

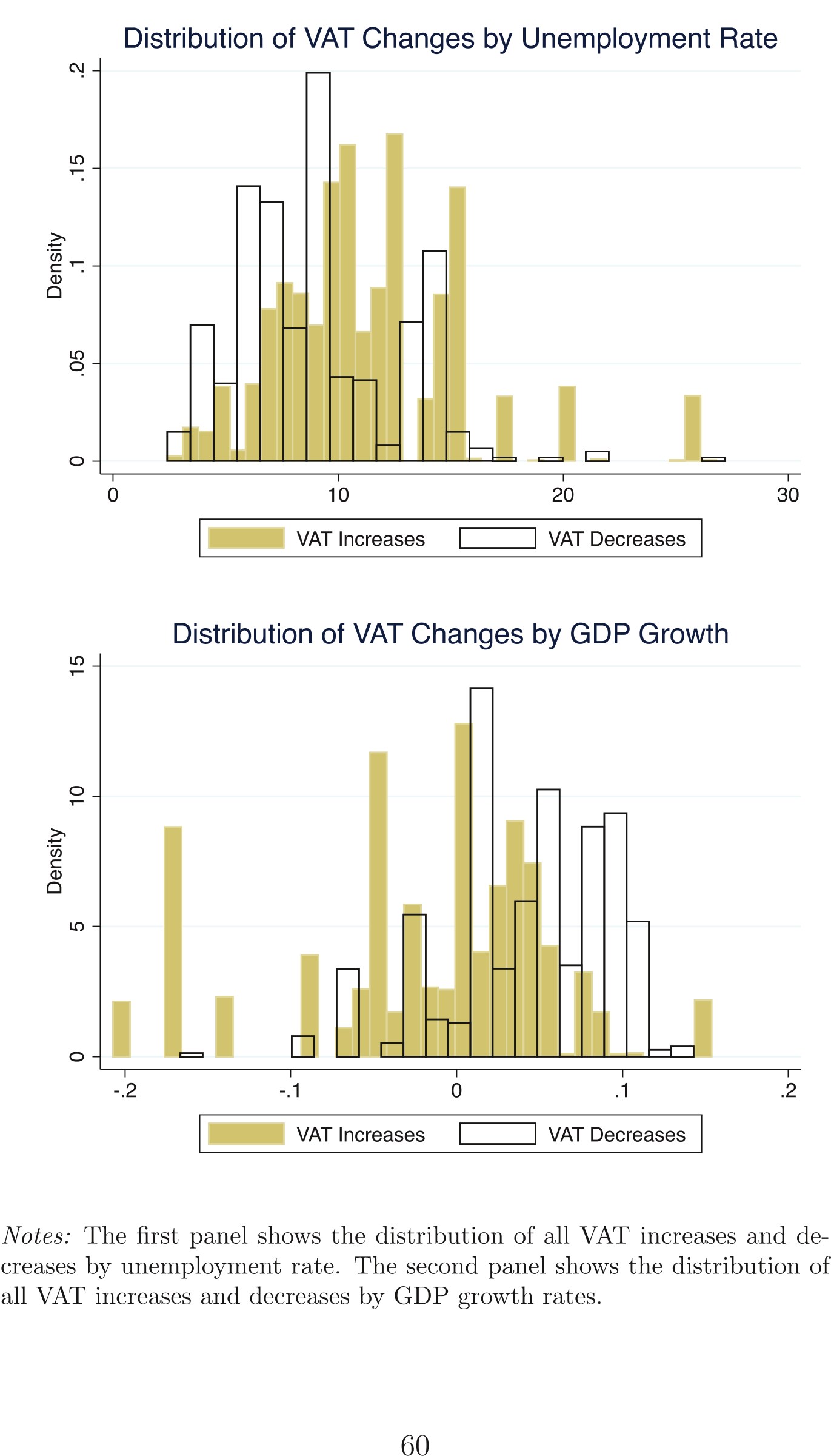

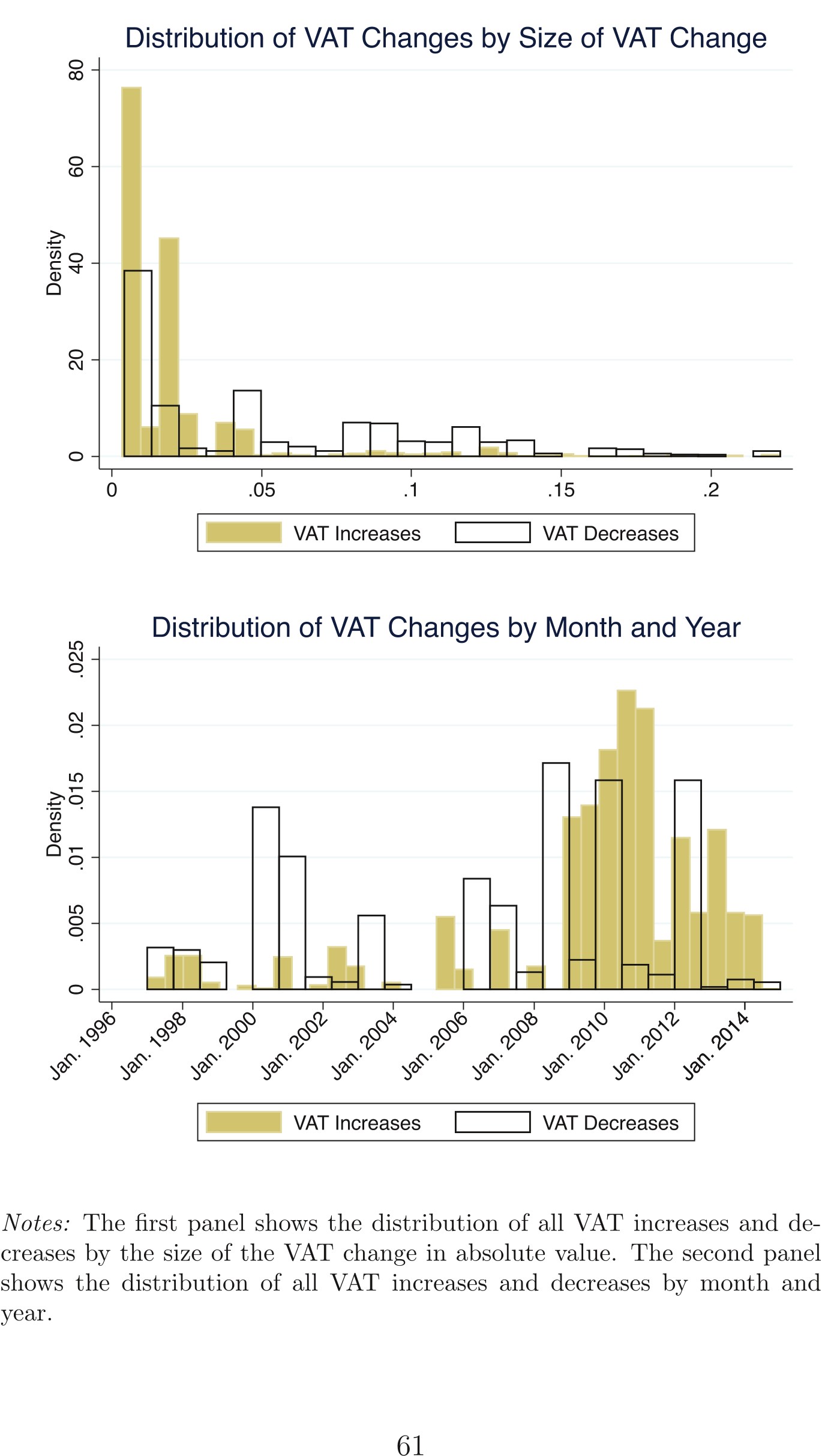

Figure D.10: Summary Statistics: Economic Conditions

Figure D.11: Summary Statistics: Size and Timing

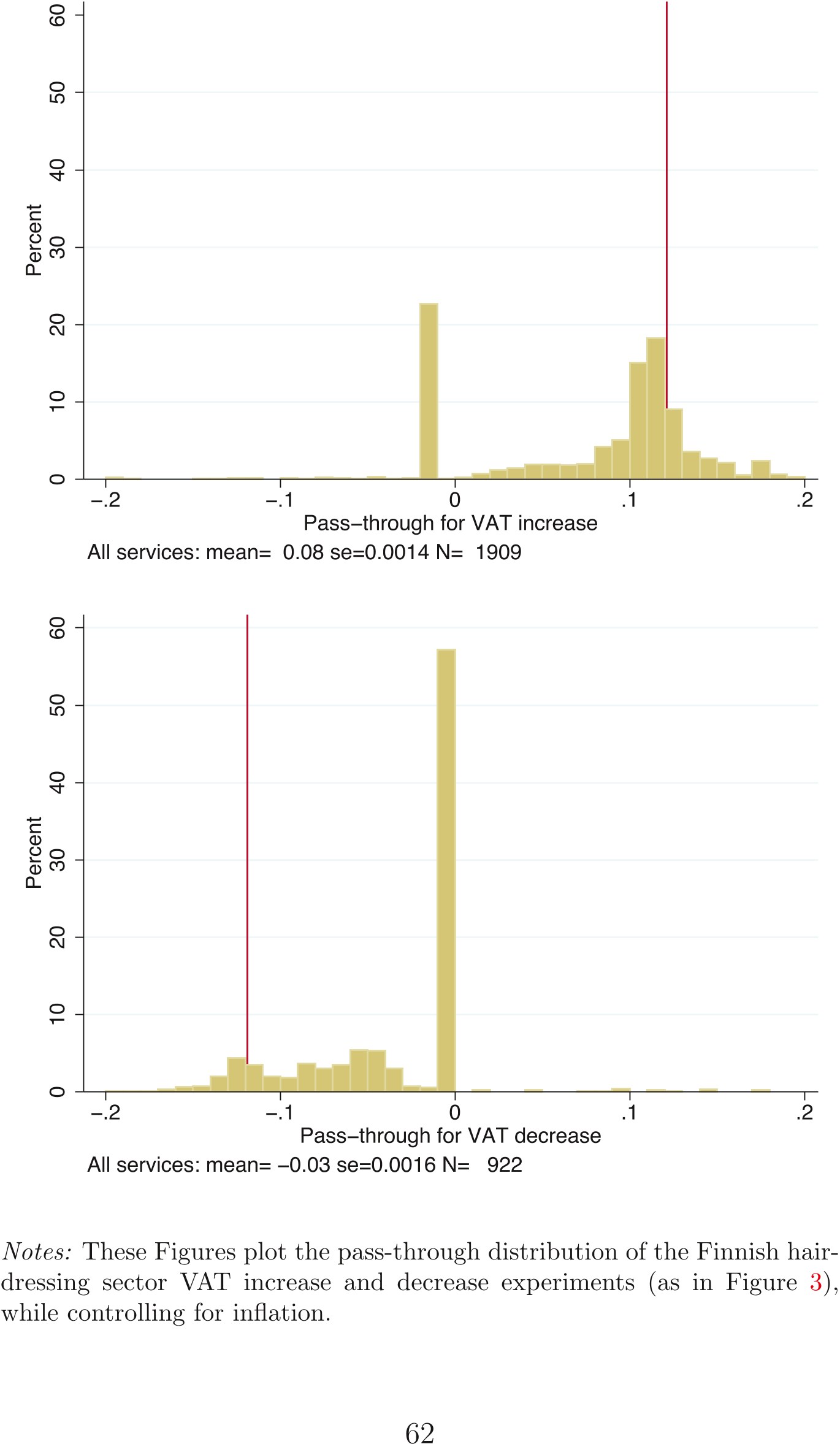

Figure D.12: Finnish Hairdressing VAT Reforms Pass-Through Distributions With Co...

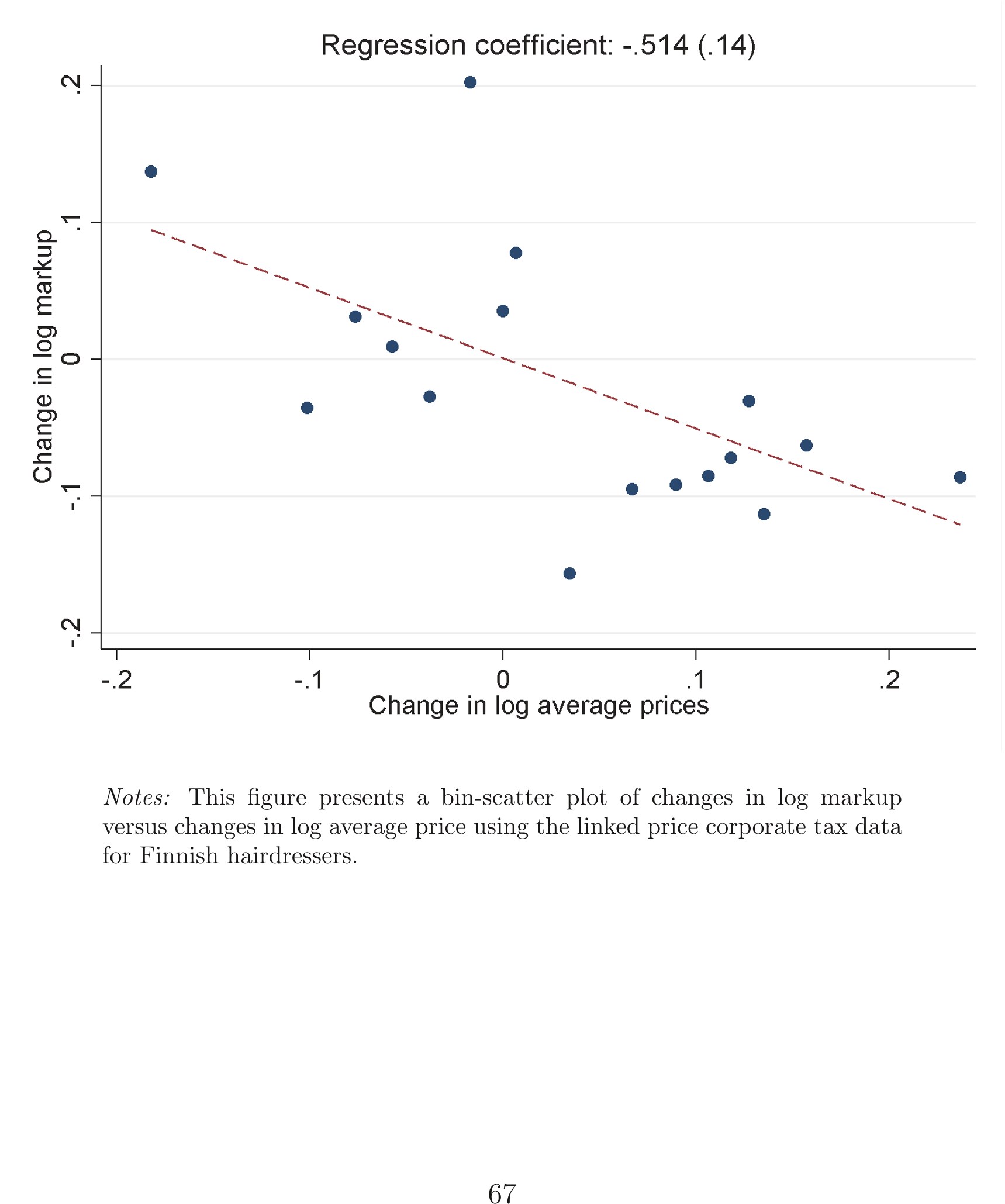

Figure D.17: Markup Changes and Price Changes

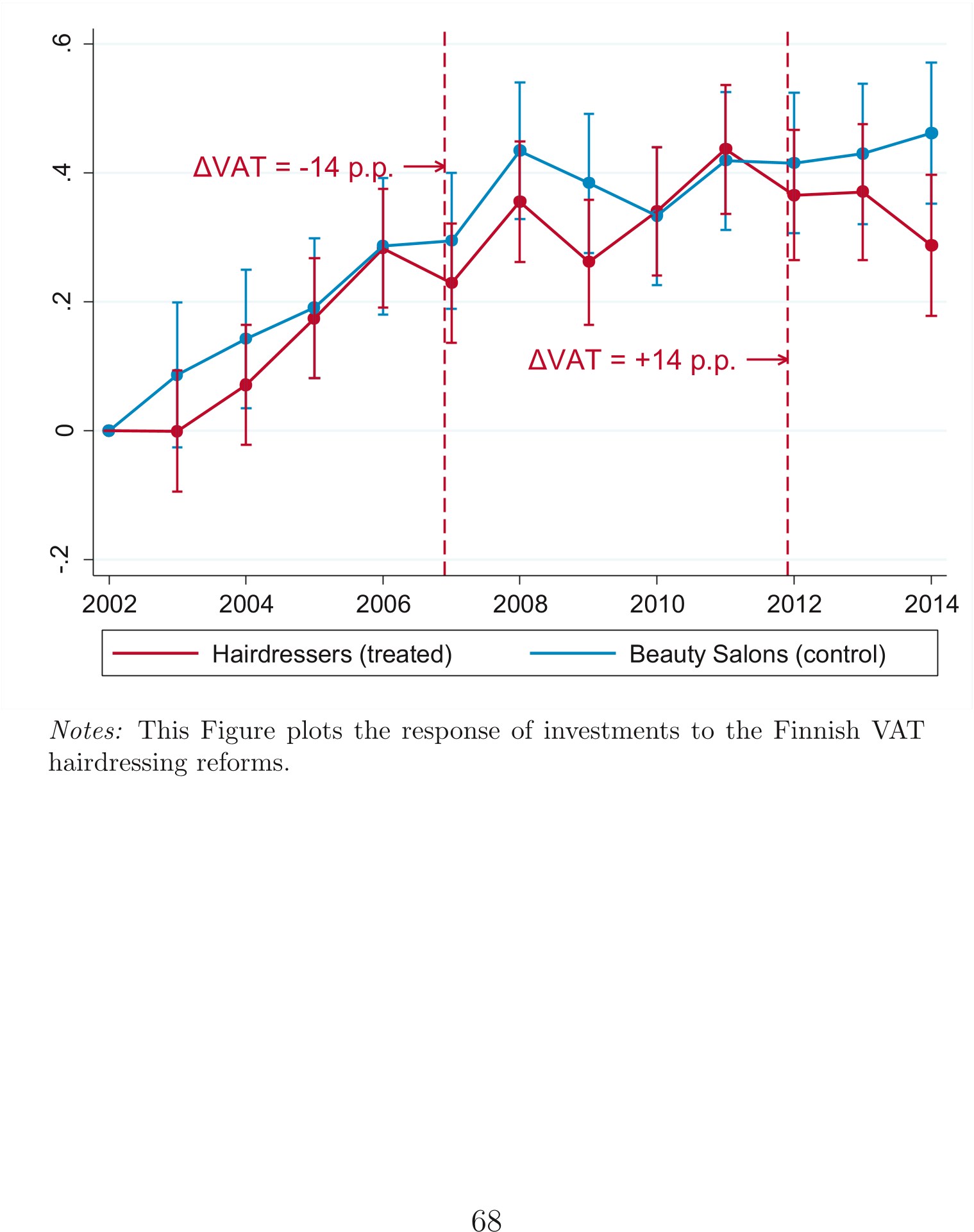

Figure D.18: Finnish Hairdressing Reforms: Investments

Paper Details

Title

What Goes Up May Not Come Down: Asymmetric Incidence of Value-Added Taxes

Published Date

Jun 29, 2020

Journal

Volume

128

Issue

12

Pages

4438 - 4474

TrendsPro

You’ll need to upgrade your plan to Pro

Looking to understand a paper’s academic impact over time?

- Scinapse’s Citation Trends graph enables the impact assessment of papers in adjacent fields.

- Assess paper quality within the same journal or volume, irrespective of the year or field, and track the changes in the attention a paper received over time.

Citation AnalysisPro

You’ll need to upgrade your plan to Pro

Looking to understand the true influence of a researcher’s work across journals & affiliations?

- Scinapse’s Top 10 Citation Journals & Affiliations graph reveals the quality and authenticity of citations received by a paper.

- Discover whether citations have been inflated due to self-citations, or if citations include institutional bias.